Nowadays, running an ecommerce business is a whole lot easier if we can ensure customer payment is easy and safe. According to research, global ecommerce sales reached over $4.32 trillion in 2025 with a year-on-year increase of 8.02%. Amazing figures. However, the downside is that approximately 13% of all shoppers abandon their carts because there are limited payment options available. Online payment gateways provide an excellent solution!

In Thailand and for Southeast Asian markets, the K Payment Gateway was built by Kasikornbank to enable you to accept payments easily.

This guide’s going to cover just about everything you want to know about the K Payment Gateway. We’ll outline the features and benefits, and get you through the setup step-by-step. It doesn’t matter if you’re looking for a k payment gateway integration or if you’re just here for a k payment gateway review; you’re going to be able to implement tips that are useful for any solution you need for your online store.

We’re going to be focusing on solutions and not just k payment gateway integration, how to be able to capture sales and keep your customers happy! Let’s get started with getting your store ready for smooth transactions.

What is K Payment Gateway?

The K Payment Gateway is an online payment service of Kasikornbank, which is one of Thailand’s largest banks. The K Payment Gateway allows merchants to accept payments online with credit cards, debit cards, and even QR codes. It acts as an intermediary between your ecommerce site and the banking system by discovering if the payment is good to go (without compromising sensitive data directly) from the customer by the customer entering their payment details into the gateway.

Why’s this useful for your store? Because payment processing will reach $61.1 billion globally in 2025, and many more people are shopping online. For business in Thailand, K Payment Gateway is terrific because it is designed to meet local needs. It accepts Thai Baht and other currencies, making it an ideal payment gateway for ecommerce. Plus, the K Payment Gateway is PCI-DSS compliant and follows a strict set of security guidelines for data.

If you’re using WooCommerce, Odoo, or your own custom site, the K Payment Gateway is a great fit as well. Believe it or not, the K Payment Gateway is not just for big businesses, as even small shops and new start-ups are utilizing it. In short, it is a great way to process payments safely and efficiently, and can scale up as your business grows.

Why Choose K Payment Gateway for Your Online Store?

Growing Market Demand

These days, online payment processing has never been more important! It is estimated that roughly 53% of the entire global population used some kind of digital wallet to complete online transactions in 2024! With each new development, more and more customers are expecting to have multiple payment options when they shop online.

Competitive Advantage

As for the rest of the world, PayPal (45.39%), Stripe (17.33%), and Shopify Pay Installments (15.73%) were the three most used payment processing technologies worldwide as of August 2024. However, although these three are the most popular, k payment gateway contains certain advantages for specific markets and types of business.

Market Growth

The Asia Pacific market is expected to grow from USD 10.2 billion in 2024 to USD 19.6 billion by 2029 at a CAGR of 13.9%. This is a great time to set up your payment processing infrastructure.

Key Features of K Payment Gateway

When it comes to choosing a payment tool, the features are everything. The K Payment Gateway provides a handful of features that address some familiar ecommerce pain points. Let’s look in detail.

To start with, card payments are with choice. There are both 3D Secure and non-3D Secure supported payments. Non-3D payments have a speed advantage when it comes to low-risk purchases, and 3D Secure means there is an extra step to verify the payment. This will result in fewer declined payments and happier customers.

Next, there are QR code payments. In Thailand, the QR codes dominate – they represent over 70% of digital payments in the market. Customers scan the code using their banking app, and your merchant account gets their payment almost immediately. This is perfect for mobile shoppers, as mobile shoppers accounted for almost half of the U.S. ecommerce sales (US$900 billion in 2025). Half of that for your store – what a winter we could have!

And let’s talk tokenization for saved cards. Customers have peace of mind with their information saved securely, while repeat customers get super-easy one-click purchasing! It reduces the time for the checkout process and combats the cart abandonment battle.

Other features in a k payment gateway include installments on large purchases, multi-currency capabilities, and the ability to provide API access for customizations. You can also monitor transactions in real-time via a merchant portal. Guy’s it adds up to a flexible experience regardless of your store size.

In reviews of k payment gateways, seemingly users love how these features support high volumes of transactions without any hiccups. E.g., processes charging over cards, QR, and more with fast settlements.

Benefits of Using K Payment Gateway for Ecommerce

Picking the right payment gateway isn’t about the tech; it’s about the direct benefits to the business. Here are the best things about K Payment Gateway for your online store.

First, security: With 3D Secure and tokenization, fraud risk is reduced. Payment fraud is a global problem and thus an ever-growing concern; however, the above tools allow your store to be protected. Consumers will complete more transactions with businesses that protect their personal and financial information.

More payment types equal more conversions: With cards, QR, and installments, you are now covering the main ways shoppers wish to pay. Remember that 13% abandonment statistic? A wider range of payment methods can chop that in half. For Thai e-commerce, QR codes take advantage of local habits and provide value for mobile purchases.

Quick and easy to set up: K Payment Gateway has straightforward integration pathways. You do not need a tech team; basic coding works to get up and running. As for settlements? Typically, T+1, so cash is flowing faster.

Cost saving: Fees are competitive in Thailand and with no hidden fees on fundamentals, once you start growing your sales (in line with the global gateways market planned to be $161 billion by 2032), scaling your business will not be costly.

Local support: As a Kasikornbank product, you have local Thai experts on your side addressing things like Baht fluctuation and local regulatory issues. Some of the global giants have never thought of or dealt with local specifics.

In sum, including all these advantages, K Payment Gateway can offer a good solution for ecommerce merchants wanting to achieve steady growth.

K Payment Gateway Review: Pros and Cons

No tool is perfect, so here’s a balanced k payment gateway review based on user feedback and 2025 trends.

Pros:

- Easy to integrate, especially with the button option.

- Strong local support for Thai merchants.

- Versatile features like QR and installments.

- Reliable uptime and fast payouts.

Cons:

- Mainly for Thailand’s global reach is limited.

- API setup needs some coding know-how.

- Fees might add up for very high volumes.

Users on forums say it’s great for mid-sized shops, scoring high on ease (4.5/5 average). In 2025, with rising digital payments, it holds up well against rivals.

Prerequisites Before Setting Up K Payment Gateway

Business Requirements

To integrate the K Payment Gateway, ensure your business meets these essentials:

- Registered Website: A live, secure website (HTTPS) with a valid domain.

- Business Bank Account: A verified bank account for transaction settlements.

- KYC Documents: Valid business registration, tax ID, and owner’s identity proof (e.g., passport, PAN card).

- Compliance: Adherence to local regulations and PCI DSS standards for secure transactions.

Technical Requirements

Prepare the following for seamless integration:

- Compatible Ecommerce Platform: Platforms like WooCommerce, Shopify, or Magento with K Payment Gateway support.

- Plugins/APIs: Install the official K Payment Gateway plugin or use its API for custom integrations.

- SSL Certificate: Ensure your website has a valid SSL certificate for secure data transmission.

Things to Prepare Before Integration

- Obtain the K Payment Gateway merchant account credentials.

- Test API keys in a sandbox environment.

- Ensure your website supports redirect or iframe-based payment flows.

How to Set Up K Payment Gateway: Step-by-Step Guide

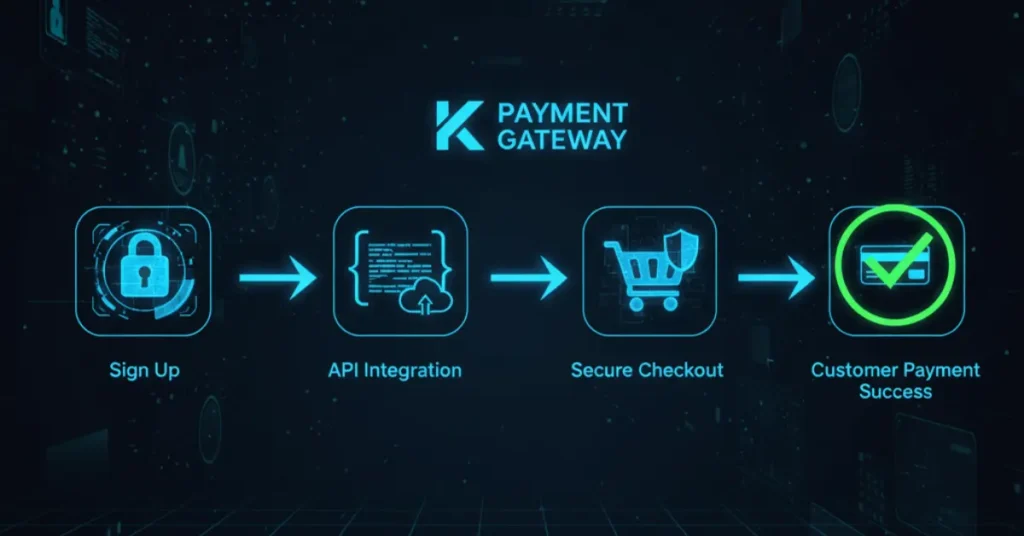

Integrating K Payment Gateway can be easy! Here is a high-level overview of the steps for k payment gateway integration, covering both methods: K-Pay Button (the easy way) or the more complicated Direct API.

Step 1: Sign Up and Get Approved

First, go to the Kasikornbank webpage or send an inquiry to their business department. Complete their merchant application. The merchant application includes your store information, such as business type and expected volume. They will run a compliance check after submission (which can take 1-3 days). Upon approval, you will receive your Merchant ID, Public Key, and Secret Key. Be sure to keep your Secret Key in a safe place, as it works like a password.

Step 2: Choose Your Integration Type

- K-Pay Button (Recommended for Beginners): This embeds a button on your checkout. No need for PCI compliance since you don’t touch card data.

- Direct API: For full control, but you handle more security rules.

Pick based on your tech setup. For WooCommerce or Odoo, plugins make it simpler.

Step 3: Set Up Your Development Environment

Finally, start with the sandbox/test mode. You can send an email to Kasikornbank for a test account, and they will respond with login information. You can then download test card numbers from their documentation. This will allow you to test and practice payments without the use of real dollars.

Step 4: Integrate the K-Pay Button

- Add the script to your site: Copy the provided JS code into your checkout page header.

Configure the button: Set params like API key, amount, currency (THB default), and merchant ID. For example:

text

<script src=”https://gateway.kasikornbank.com/kpg/js/kpg.js”></script>

- <button id=”kpay-button”>Pay Now</button>

- Handle callbacks: When clicked, it opens the payment UI. On success, it sends back a token or status to your server.

Test a full flow: Add item to cart, checkout, pay with test card. Check for errors.

Step 5: Add Advanced Features

- For QR: Set payment_method to “QR” in config. Call the Order API first for an ID.

- For 3D Secure: In Charge API, flag it on. Redirect for auth, then inquire.

- Tokenize cards: Enable the save_card flag to store for later.

Step 6: Go Live and Test Again

Switch to production keys. Run end-to-end tests with real (small) transactions and monitor the merchant portal for logs.

Step 7: Optimize and Maintain

If needed, link to your ERP. (i.e., Odoo integration) Set up webhooks for instant updates. I also recommend checking for updates from Kasikorn regularly.

This setup usually takes 1-2 weeks for most to complete. If you get stuck, their support should be good.

Best Practices for Using K Payment Gateway

To make sure the K Payment Gateway is optimized for taking safe and efficient payments, follow these best practices. First, you should always stay on the current versions of both your software and plugins. By doing so, you’ll have the necessary compatibility with newer versions of your chosen payment gateway, benefit from better performance, and stay on top of security vulnerabilities when the developers patch the software after battle testing it.

If you’re consistently applying updates to your platform, you’ll keep the customer’s transaction experience free from exploits and with minimal interruptions. Second, optimize for a secure website by guaranteeing the SSL is valid since encrypting data adds a layer of comfort to your customers without the need for a new password.

Having a secure website ensures a level of security for you and your customers for sensitive information while keeping with industry standards. Third, have a powerful fraud detection and alert system that tracks and alerts you in real-time from your dashboard for all transactions, so you’ll notice suspicious things as they happen, leading to less financial loss and less chance of chargebacks.

Finally, provide a few different payment types for vacationers to choose from – credit cards, digital wallets, bank wires, etc. Being flexible helps users be satisfied and improves final conversions.

By incorporating these practices – keeping software updated, securing the website with SSL, enabling fraud detection, and offering multiple payment types – organizations can optimize the efficiency, security, and reliability of the K Payment Gateway, building trust and facilitating greater growth in online payments.

Common Issues & Troubleshooting

Users will regularly face typical problems with payment systems like failed transactions, API problems, or issues with currency or payment coverage. Knowing how to troubleshoot and remedy these problems is key to your operations running smoothly.

Failed Transactions: Typically happen because of incorrect payment details, the user not having sufficient funds, or there are gateway timeouts. To troubleshoot, a user can verify any card details or account balances, testing on a reliable internet source, and retrying the transaction. If nothing leads to a positive option because of former failed attempts, a user can escalate their troubleshooting guide to a support area for the payment provider, so they offer specific codes to match errors or identify restrictions to the account.

API Errors During Integration: API problems usually arise from incorrect API keys, old versions of the SDK, or issues with endpoint configuration. The user can troubleshoot API errors in equally as many ways. Check that the API credentials are correct; if there are updates, consider the different versions of the API available; re-check the format of the requests the user needs to complete according to the documentation; and check that detailed logging is enabled to quickly capture error messages the next time they happen.

Currency or Payment Method Compatibility: Mismatches can occur when the merchant’s selected currencies or payment methods are not supported in the gateway or region. Verify with the gateway’s documentation which currencies and methods are supported before deciding on implementation. Use fallback options or prompt the user to select an alternative.

Resolving issuers or payment processor blocks or rejections can be accompanied by proactive monitoring, making certain robust error handling exists, provider support is received when needed, and integration code is frequently maintained. Regularly patched and tested integration code allows merchants to avoid disruptions and provide great payment experiences in their eCommerce stores.

Key Takeaways

- Global ecommerce is $4.32T in 2025, don’t miss out on poor payments.

- Use the K-Pay Button for quick k payment gateway integration without PCI hassle.

- QR payments tap into Thailand’s mobile boom for higher sales.

- Test thoroughly in the sandbox to avoid live issues.

- Diverse options reduce the 13% cart abandonment risk.

- Regular monitoring keeps your setup running smoothly.

Conclusion

Implementing a K Payment Gateway in your eCommerce business is a proactive step to support faster growth of your business, as the digital payments market is projected to reach USD 37.0 billion over the next year. Choosing the right payment gateway is more important nowadays than ever! The K Payment Gateway solution provides a complete payment solution that is secure, reliable, and easy to use!

The K Payment Gateway transaction was completed in a very short time frame and offered many advanced tools to assist your eCommerce transactions, including fraud detection features and multi-currency transactions, ensuring your business has an easy way to conduct all its eCommerce transactions.

Along with great features, product pricing is competitive, easy integrations, responsive customer service, and a strong focus on compliance and security to protect your customers and gain their trust are key to establishing good transactions with customers. Ultimately, by adding the K Payment Gateway, you’ve established good payments by building for better stability and growth, by sharing better shopping experiences for customers.

FAQs

How long does it take to set up a K Payment Gateway account?

You can expect the whole setup process to take about 3-5 business days from the time you submit your application until you’re live. This includes document verification, account approval, and integration testing.

What documents do I need to apply for an account?

You’ll need some business registration documents, tax identification, bank account verification, and identification documents for authorized signers. Specific requirements may differ depending on the type of business and the location.

Is there a minimum transaction volume requirement?

While there is no strict minimum, low-volume accounts may be liable for minimum monthly fees. Contact sales for specific guidance based on your anticipated transaction volume.

Do I need technical expertise to integrate k payment gateway?

Not exactly. We offer several integration methods, including plugins for common ecommerce platforms that do not require coding at all. Custom integrations may need the assistance of a developer.

Can I test the integration before going live?

Yeah, we offer a full sandbox environment with test credentials and sample data. You’ll be able to completely test all payment types and scenarios before going live with real transactions.

What payment methods are supported?

You can accept major credit and debit cards (Visa, Mastercard, JCB, American Express), digital wallets, bank transfers, and local payment types based on your region.

How quickly are funds settled into my account?

The standard settlement is usually 1-2 business days. There are express settlement options that might be available for qualifying merchants at an additional cost.

How secure is the k payment gateway?

We’re PCI DSS Level 1 compliant and use normal industry encryption methods. All sensitive data is tokenized and encrypted while it is being transmitted and at rest.

What fraud protection measures are included?

Our platform contains real-time fraud detection, customizable risk rules, and machine learning to identify suspicious transactions. Other fraud protection services are an option as well.

Are there any hidden fees?

No, we’re transparent in our pricing with all fees clearly outlined. We will outline standard fees to process a transaction, and other fees, like chargebacks or express settlement, are priced separately.